It’s hot and dusty, desolate and sometimes dangerous. It’s teeming with snakes and other reptiles. But hidden under the surface of the Permian Basin is liquid gold ― large stores of untapped oil and natural gas.

The basin spans about 75,000 square miles of remote land in west Texas and southeast New Mexico. Companies have been drilling in the area for decades, but until recently, that drilling didn’t get a lot of attention.

Then, everything changed.

This year the Permian Basin will produce 3.9 million barrels per day, about a third of all U.S. oil production, according to the U.S. Department of Energy. The Permian output, coupled with other shale operations, has made the U.S. the world’s largest producer of crude oil, ahead of Saudi Arabia and Russia.

The oil boom in the Permian is a direct result of fracking and other technology advances that have dramatically improved the way oil is extracted from the ground, according to Chad Johnson, midstream business line manager with Kiewit Energy Group Inc.

“The Permian has always been a known commodity but there were many logistics challenges,” he said. “With fracking, they can now drill down and then horizontally for more than two miles.” That made the area more lucrative for big players like Exxon, Shell, Chevron and Anadarko, he added. Two other factors that played a role in the Permian oil boom were the lifting of a ban on U.S. oil exports and a sharp decline in oil prices. With declining prices and the high cost of offshore drilling, the shale deposits became more attractive.

Oil production in the Permian Basin is expected to continue climbing for the foreseeable future and Kiewit sees huge potential in the coming years.

“There aren’t very many companies that offer the wide range of solutions that Kiewit does,” said Johnson. Kiewit companies already involved or planning to pursue work in the Permian include: TIC – The Industrial Company (TIC), Kiewit Offshore Services, Ltd. (KOS), Kiewit Engineering Group, Inc. (KEG), Kiewit Power Constructors Co. and Kiewit Infrastructure South Co.

“There is a lot of work available, and we are positioned well to grow our presence in this midstream market,” he said. TIC found a niche in building gathering facilities for oil, gas and water. The oil and gas are refined before moving along through the pipelines. Water is trucked out or pumped back into the ground.

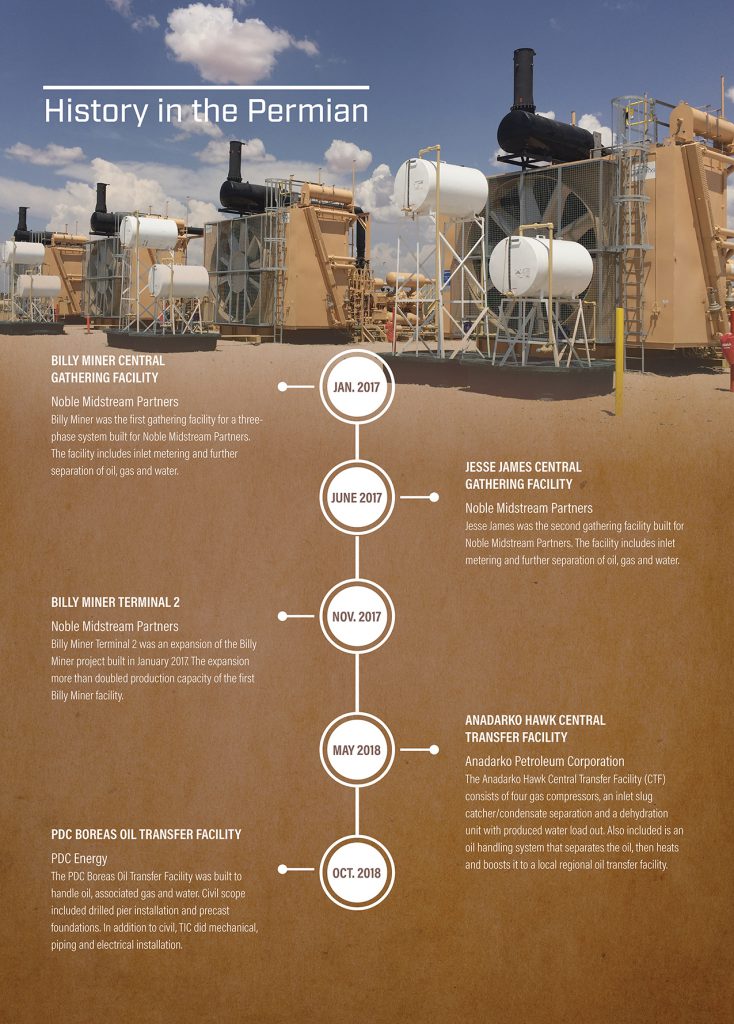

TIC has built five gathering facilities since 2017, including three for Noble Midstream Partners, and one each for Anadarko Petroleum Corporation and PDC Energy. Kris Boothe has sponsored all but one of the Permian Basin jobs. He also sponsored a couple of projects in the North Dakota Bakken shale basin.

“The Permian Basin is more promising,” Boothe said. “It’s easier to get the oil out of the ground so drilling is cheaper, and the weather is conducive to working year-round.”

Permian challenges

Working in the Permian Basin area comes with significant challenges. Boothe said the biggest challenge is hiring enough people ― there’s more work to do than there are people available. Housing for staff and craft is scarce with the cheapest motel rooms going for $280 a night. The housing shortage has spawned the growth of several “man camps” and the company reserves space for employees working in the area.

The problem, Boothe said, is that not a lot of people want to live in the camps. Many are taking to the roads and driving to and from work every day. That adds to the traffic congestion on roads already busy with truck traffic, including water tankers, plant equipment, cranes and other construction equipment.

In 2017, there were 43,661 traffic accidents in the Permian Basin that resulted in 405 fatalities and 1,457 serious injuries, according to the Texas Department of Transportation.

“The two-lane highways in this area weren’t designed for this type of traffic and are some of the deadliest anywhere,” said Boothe. “Accidents occur every day and a 15-mile drive can take over an hour.”

In an effort to mitigate risk, TIC runs flexible shifts, where appropriate, and plans ahead to avoid unnecessary road trips.

“We have a fantastic safety record, which is key to our success,” said Boothe. “We’ve been able to keep the same people from job to job. They stay because they value working in a safe environment where quality matters.”

Next up

The Permian Basin includes three sub-basins: Midland, Central and Delaware. Kiewit’s focus has been and continues to be the Delaware Basin. The next project on the agenda is a gathering facility for XTO Energy Inc., a subsidiary of ExxonMobil. The job is in the Delaware Basin of southern New Mexico and involves several Kiewit companies. TIC is building the station. KEG in Houston did the upfront engineering, KOS completed the module fabrication and structural steel, and Kiewit Infrastructure South Co. did the pad development.

Also known as the Bulldog station, the XTO project is TIC’s first gathering facility in New Mexico.

“KEG worked with XTO to optimize the compression facility design and TIC is building the Bulldog station using the new design,” said Project Sponsor Robert Strephans.

The Bulldog station will be TIC’s largest to date with three large compressors and capacity to expand to nine, said Strephans. Because of its location between Carlsbad and Hobbs, New Mexico, the project won’t have some of the logistics problems experienced elsewhere in the Permian.

The closest places to live are the camps in Carlsbad, but space there is limited, so many of the workers opt to find housing in Hobbs, which is about 45 minutes away. The Hobbs Highway has two lanes in each direction for better traffic flow.

Future work

Kiewit recently opened a small office in Midland, Texas, that serves as a central point for hiring and gives the company a better presence in the area. That’s important, Johnson said, because the company is looking at expanding operations in the basin.

“Some of our clients are looking at this as a 30- to 40-year play,” said Johnson. “Well count in the Permian is expected to increase 91 percent, and these wells are expected to produce 5.4 million barrels per day by 2023.”

Kiewit companies are looking to capture some of the work, including pipe fabrication, pipe rack, pipeline pump stations, initial separation facilities and refining facilities.