Harnessing the power of sunlight and wind has become a top priority for Kiewit Energy Group Inc. (KEG) as the market for renewable energy continues to grow and become more profitable.

“We’re in it and we’re going to stay in it,” said Stephen Packard, who leads Kiewit’s efforts in renewables. “If we want to be solution providers for our power clients, we need to be able to do everything in their portfolio, and that includes all types of renewable energy projects.”

Kiewit’s current focus is on solar, onshore and offshore wind, energy storage and power delivery.

“Renewable energy generation has become more cost competitive as better technology is introduced, and the best is yet to come,” Packard said.

Why now?

Jacob Albers, KEG’s business line manager for wind, attributes the strong growth in renewables to three key drivers: government policies, public perception and price.

States have implemented Renewable Portfolio Standards ― mandates that a certain percentage of power come from renewable sources by a certain date. The pressure is on to meet these goals, said Albers.

Public perception is also driving the recent surge in renewables.

“There’s been a significant shift in the past couple of years with large private companies coming in and buying power directly from the developers,” said Albers. “They’re saying, ‘I want 100% renewable energy and I’m going to figure out how to do that.’ So, they contract directly with the developers of a wind or solar farm.”

In the past, developers typically transferred ownership or sold the power to utility companies. But now, these commercial and industrial buyers are disrupting the old business model, typically by setting up virtual power purchase agreements (PPAs) directly with the developer. Albers said it’s really just a paper transaction as these companies are not directly connected to the wind or solar farm. Through the virtual PPA, they’re able to claim the energy added to the power grid by these renewable power plants.

“Utilities are getting in the mix with their own projects too, but these commercial and industrial customers that are buying renewable power directly are driving a major piece of where the market is headed,” he said. “What you’re seeing is companies pressuring utilities for renewable energy.”

Price is also a key driver in the growth of renewables. A mix of production tax credits (PTCs) for wind and investment tax credits (ITCs) for solar have made it easier for developers to get into the market. Multi-year extensions of both types of tax credits at the end of 2015 gave the industry a long enough runway to plan for sustained projects. Further extensions were issued by the IRS in May 2020, which will provide some relief for renewable projects affected by COVID-19.

The tax credits have piqued the interest of more investors, but it’s also given the market time to mature with improved technology that’s bringing the cost down further. Even without the subsidies, which will be phased out in the coming years, the cost of generating energy from renewables is cost competitive, according to Albers.

The hub of this Vestas V150-4.2 megawatt turbine is shown being set on the nacelle. The blades will be attached to the hub, which is 105 meters high.

The hub of this Vestas V150-4.2 megawatt turbine is shown being set on the nacelle. The blades will be attached to the hub, which is 105 meters high.

Making an impact with solar energy

“We believe right now that the biggest market we have is solar, with projected revenue of $500 million to $600 million in the next three years,” said Packard.

Kiewit has anywhere from five to 10 solar projects in progress at any given time. The model varies from project to project ― from electrical subcontract-only through Mass. Electric Construction Co. (MEC) to engineer, procure, construct (EPC) projects through KEG.

Solar isn’t new to Kiewit; MEC has been installing solar panels for more than 10 years, adding more than a gigawatt of energy to the grid. Kiewit has also been providing engineering-only solutions for about three years, helping small developers and large power clients with basic things like permit drawings, performance calculations, site layout and tie-ins to assets they already have.

What’s new is KEG’s plan to bring the EPC model to the renewables market, and it’s generated a lot of interest from clients and potential clients.

“Kiewit is always on the forefront, looking to diversify and trying to project where we think the markets are going to go,” said Jake Strickland, solar business line manager. “Renewables is going to be a strong market and we’re making sure we’re part of it and can make a big impact for our clients.”

Strickland said his group set a goal to book enough projects in 2020 to add about 600 megawatts to the grid and then double the megawatts each year for the next five years.

There’s nothing complex about solar work but there are some unique challenges.

“Solar is a quantity problem. When you have 1.3 million solar panels on a 600MW job and you’re off by two minutes a panel, it can scale up to millions of dollars,” said Strickland. “Every second, every minute counts in solar because of the quantity involved. It’s repetitive, but with massive quantities, and that’s the challenge.”

The same 600MW job can take 3,000 to 4,000 acres of land. There is a huge civil component, including site preparation, access roads for maintenance, drainage solutions, geotech permitting and management of environmental concerns. Even fencing can turn into millions of dollars.

“That’s where we think we have the huge advantage and where we think we are going to make a big impact in this market,” he said. “We have the tools and processes, the experience and the discipline to attack those kinds of problems.”

Technology in the solar market continues to improve, with new panels able to increase output and lower cost. For example, new bi-facial panels capture sun from both sides, the front from direct sunlight and the back from the reflection off the ground, resulting in 20% more output per panel.

KEG has solar experts ― engineers who specialize in using PVsyst technology to model and optimize solar fields. Jon Gribble, who leads the power engineering group, said the technology can pinpoint the amount of radiance from the sun that a specific location will receive, and calculates solar output daily throughout a year.

The PVsyst technology also factors in shade from trees and undulations in the land. Gribble said engineers can jockey the number, placement and angle of solar panels to optimize the site, which is critical considering there can be more than 1 million panels spread across thousands of acres.

In addition to the engineering, Kiewit brings stability as a company, flexibility to help clients mitigate risk, different contracting models and an industry-leading safety record, said Strickland, adding that they have received a fantastic response from clients.

“Our ability to self-perform or subcontract any of the parts and pieces buys us a lot of value with clients, as well as the overall scope breadth that we can provide,” he said. Kiewit’s ability to work anywhere in North America is another big selling point.

Field engineers at the Timber Road IV project are (from left to right) Andrew Johnson, Tyler Williamson, Scout Crow and Ryan Halbur.

The Hoosac Wind Farm in Massachusetts included installation of a 34.5-kilovolt underground collector system for the wind farm’s 19 turbines and construction of the substation.

The base section of a wind turbine is set at Timber Road IV. Each wind turbine has five to six tower sections.

Onshore wind solutions

KEG currently has five onshore wind projects under contract ― two in Indiana, and one each in Ohio, South Dakota and Texas. Combined, these projects will add over 900 megawatts to the power grid.

A typical wind farm has from 25 to 100 turbines, depending on the size of the turbines used. Albers said turbines can range from 80 to 120 meters high and from 2.2 megawatts up to 5 megawatts. As the generators get bigger, blades are getting bigger and the diameters of wind turbines are getting bigger, above 160 meters on some of the larger ones.

“These projects are simplistic from an equipment standpoint, but they are logistically very challenging,” said Albers. “One of the biggest selling points for us is our ability to invest in the right equipment.”

Kiewit recently purchased two large cranes to help with installation of new-generation turbines that are bigger and more complex. The cranes can be used on other projects, but they are specifically targeted at building the bigger wind turbines that the market’s seeing right now.

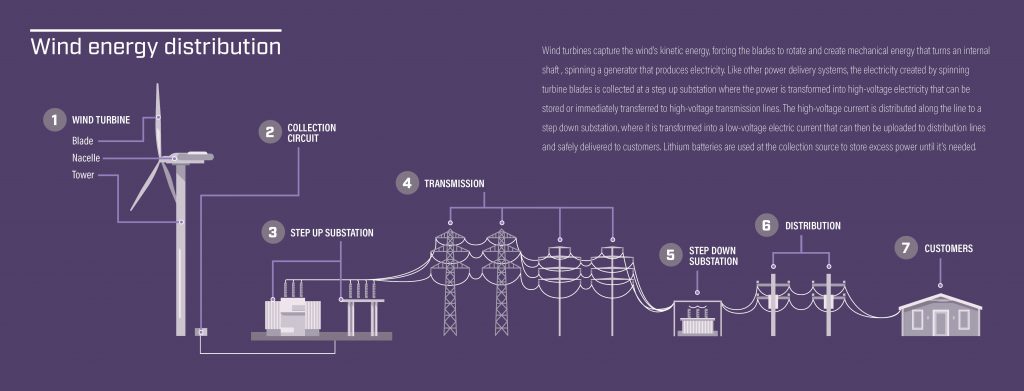

Why is the crane so important? An average turbine is comprised of a tower (base and two to six middle and top sections), a nacelle (holds generator and other internal components), the hub (attached to the nacelle and holds the blades) and the blades.

“The nacelle is about the size of a small school bus,” said Albers. “With the new cranes we will be able to pick the nacelle fully loaded instead of using multiple picks for the nacelle and internal components.”

The new equipment will be deployed on a couple of projects coming up this year ― Rosewater and Headwaters II. Albers said both projects are using Vestas wind turbines, some of the largest turbines available for installation in the U.S. right now.

Kiewit can provide a full, turnkey solution on wind projects, Albers said, including engineering, access roads, foundations, electrical collection systems, substations and transmission line systems.

MEC installed conduit, cable and electrical equipment for nearly 300,000 solar modules on the 480-acre Rutherford Solar Farm in North Carolina.

MEC installed conduit, cable and electrical equipment for nearly 300,000 solar modules on the 480-acre Rutherford Solar Farm in North Carolina.

Attacking energy storage

Solar and wind projects use lithium batteries at the site to store excess energy. They charge during the day when the sun is out or when the wind is blowing, and the batteries discharge when they are needed.

“We definitely want to play in that space because 30% of contracts have a storage component,” said Packard. “We can install and hook up the batteries as well as provide complete engineering services.”

Storage is included in Kiewit’s EPC model for the solar industry. That includes work early on with the owners in the development process to help them select the right technology for battery storage.

Kiewit believes there is a bigger market for energy storage that is just getting off the ground, and KEG’s engineering group has expanded its focus beyond solar fields.

“Right now, we’re doing the engineering on the largest stand-alone battery installation in the United States,” said Gribble. “It’s a 400-megawatt facility in California at the site of an old, decommissioned coal plant.”

The specially designed facility includes thousands of batteries racked together. A critical aspect of those designs is fire protection. Once a battery enters thermal run-away, it is difficult to stop, according to Gribble.

“To mitigate thermal run-away, you need a fire protection solution that will limit the fire from spreading to adjacent batteries,” he said. Kiewit engineers have designed that fire prevention solution.

Battery storage is just one of the energy storage solutions KEG engineers are ready to tackle. Gribble said the engineering team is pivoting with clients, moving away from fossil fuels to wind and solar and “getting ahead of the curve” in energy technology.

Electrification may be the next big market, said Gribble, including everything from electric vehicle charging stations and electrical transportation feeder systems to pavement that someday may charge vehicles as they travel.

A confluence of climate change initiatives and advances in transportation electrification may provide the electric industry a pathway to additional loads previously served directly by fossil sources.

Regardless of the direction, Kiewit is diversifying to be ready to meet clients’ needs.