Preparing for P3

Public-private partnerships (P3) are an innovative solution for getting large-scale projects built efficiently, creatively and with sound financial backing. To seek out and pursue P3 opportunities, Kiewit brought together a dedicated team of P3 and finance experts, who together have more than 150 years of experience in the P3 arena with projects valued at over $30 billion.

“It’s an exciting time for us as we watch the P3 contract model really take off,” said John McArthur, president of Kiewit Development Company. “Kiewit’s strong balance sheet, combined with our diversity of market experience, our operations expertise and our resources, means that we are ready and capable to take on these jobs and be a great partner.”

Compared to most other contractors, Kiewit has a strong geographical footprint on both sides of the U.S.-Canadian border.

According to Sam Chai, senior vice president of finance and development, this footprint will lead to the pursuit of a pipeline of close to $20 billion over the next two years. “Our ability to pursue and execute on different contract models on both sides of the border is a definite asset.”

What is a P3?

A public-private partnership (P3) is between a public organization and a private entity. The private entity assumes the responsibility to develop, design, construct, finance and operate facilities and transportation projects.

There are many advantages to this type of partnership, including making large-scale projects that can positively impact communities possible. Often, government entities are not able to fully fund these projects on their own. The P3 model offers solutions for financing these undertakings. Another advantage of this delivery model is the private sector’s proven track record for delivering projects on time and on budget.

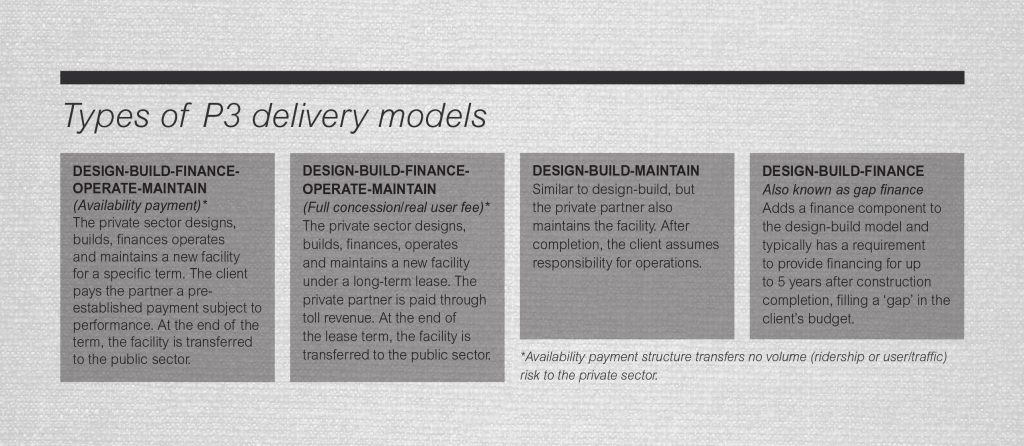

In a P3, the private sector assumes most of the construction and financial risks, far beyond the traditional responsibilities of design and build. This additional risk transfer can include operation, maintenance, short-term financing, long-term financing, gap financing, tolling and ownership in any component of the completed project.

Commonly used in Europe and Australia, P3s entered the North American marketplace in 2001 and use of the model continues to grow. All Canadian provinces allow P3 legislation; currently 35 U.S. states have it. Contract structures vary and are tailored to meet the needs of the client.